Year-End Tax Planning Opportunity: Conference Period Ends 12/18/20

December 1st, 2020

We sincerely hope that you enjoy the holidays to provide closure for this particularly challenging year. We look forward to a great 2021!

Start Tax Planning Now

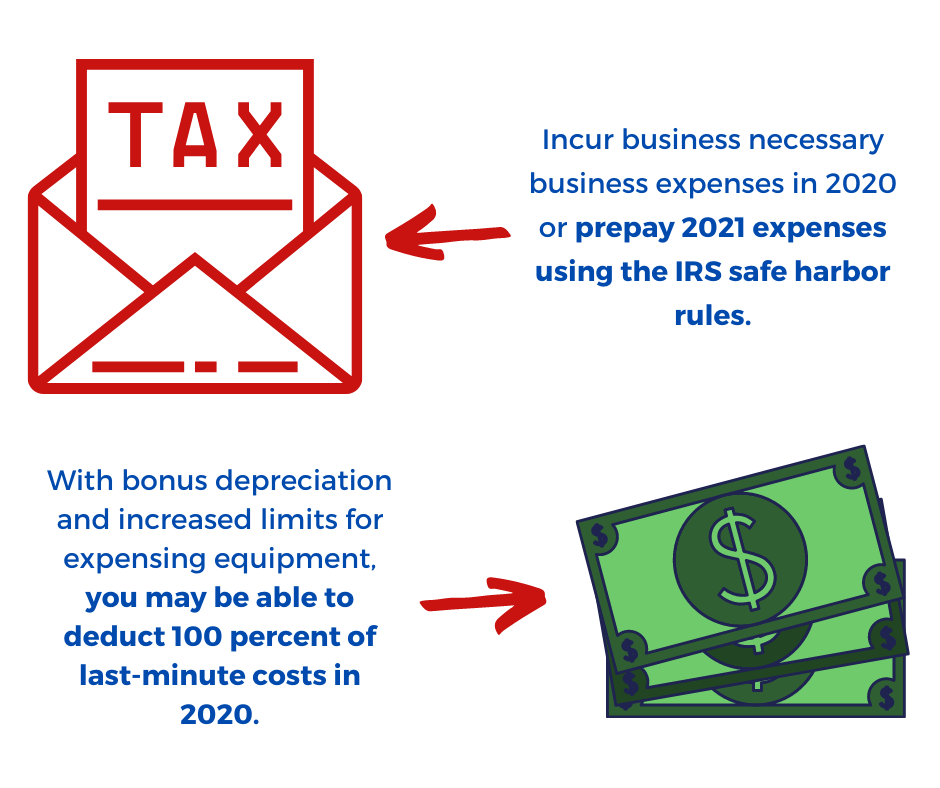

We have a couple of weeks to project your 2020 tax results and make last-minute tax-saving recommendations. Whether you simply wish to anticipate the outcome of this year’s filings to prepare financially or to mitigate the taxes as much as possible, now is the time to plan. The current pandemic may have negatively affected your ’20 income, in which case there could be opportunities for realizing capital gains and converting taxable retirement plans. We know how important tax planning can be and we do not charge current clients for this service. We’ll include a few ideas for year-end tax strategies in this correspondence, but call us for a personalized analysis.

The 2018 tax bill eliminated Unreimbursed Employee Expense deductions at the federal level.

As an employee, you can no longer write off any work-related expenses, including a home office deduction at the federal level. And yet, the pandemic has forced many employees to work from a home office. The best workaround to write off business expenses, including a home office deduction, is to set up a side business, “side hustle”. We can help you choose and set up the proper business entity for 2020. The window of opportunity to set up the entity is closing, so call us now! Set up an LLC by 12/15/20 to allow for any delays in acceptance. We can help you make the business entity decision and we can set up the entity quickly and correctly.

We are working almost exclusively by phone or video conference, remotely, securely, and effectively. Please e-mail us for remote tax preparation procedures.

Please contact Brenda@taxplus.com or call 310.398.3231 to request a phone or video conference with one of our Enrolled Agents. For our San Diego clients, please contact Rita@taxplus.com or call 858.279.1640.

We look forward to working remotely with you!

The TaxPlus Team